“Economic headwinds are increasing; inflation remains problematically elevated and financial conditions are tightening. Asset prices have experienced a sharp decline in the face of rapidly rising interest rates, slowing global growth and greater uncertainty in the macro-outlook than we have experienced in years”.

Downgrading growth forecasts as headwinds intensify

Source: Piper Sandler, Newday Impact

Our proprietary model has now started to signal a deceleration in global GDP growth for 2022. This quarter we have further reduced our forecast and now expect growth to be particularly weak in 2023. The key headwinds to the global economy include unacceptably high inflation, aggressive central-bank tightening, a global commodity shock (oil in particular), the continuation of supply-chain challenges and damage from China’s zero-tolerance COVID-19 policy. Because of this combination of headwinds, we gauge that the risk of recession is heightened over the next two years. For the developed world, this outlook translates to our model forecasting 2.5% GDP growth in 2022, less than half the 5.4% rate achieved in 2021, followed by just 1.2% growth in 2023. Except for 2020’s pandemic shock, the 2023 forecast would represent the weakest annual GDP growth performance in more than a decade. Our model is also now signaling a deceleration in the emerging-markets growth outlook and is calculating overall growth of just 3.3% in 2022 and 3.7% in 2023 for developing nations. The acceleration from one year to the next in large part reflects Russia’s economic collapse in 2022. These growth rates remain well below historical levels for emerging markets.

Unacceptably high inflation persists

Source: Piper Sandler, Newday Impact

Inflation sitting at multi-decade highs is the dominant challenge for this economic, business cycle. We expect pricing pressures to remain elevated in the short to medium term before eventually falling back toward longer-term norms. In the short term, high commodity prices, supply-chain challenges, a housing boom, and lingering tailwinds from monetary and fiscal stimulus are likely to keep inflation running hot. We look for inflation to be in a range of 6% to 8% in 2022 across most of the developed world and expect it to remain above normal in 2023, albeit meaningfully lower. Inflation pressures are broadly based but we expect them to calm as monetary and fiscal stimulus are being dialed back, commodity prices are unlikely to continue rising at the pace that they have over the past year as global growth slows. We also anticipate the housing market cools as prices feel the weight of higher interest rates. Over the longer term, we expect inflation to continue falling as structural factors such as demographics limit consumer price pressures. But we also recognize that forces such as climate change, a partial reversal of globalization and a rebalancing of powers between employers and employees may provide offsets. As a result, we expect that inflation may ultimately settle a bit higher than the Federal Reserve’s (Fed) 2% target over the long term, versus slightly below 2% over the decade prior to the pandemic.

U.S. dollar has benefited from risk aversion, weakness likely to materialize

The U.S. dollar (greenback) has steamrolled other currencies thanks to being a beneficiary from risk aversion amid Russia’s invasion of Ukraine, together with expectations that the U.S. Fed will increase interest rates faster than its global peers. Although we have pushed back the timing for when we think U.S.-dollar weakness might return, we still expect the greenback to decline in the medium to longer term given that the dollar is meaningfully above its purchasing power parity with other world currencies and that much of the Fed hawkishness and expected economic weakness abroad are already priced in. Key markers that would strengthen our conviction that the U.S. dollar may have peaked include a slowdown in U.S. economic activity, a hawkish shift in tone from the European Central Bank, signs that Asian policymakers may step in to support their currencies and/or a de-escalation of the war in Ukraine. We continue to expect the U.S. dollar to depreciate against the major developed-world currencies over the year ahead.

Interest rates globally are on the rise, quickly…

With inflation elevated globally and economic conditions tight, central banks have been forced to act urgently. Global central banks have started tightening earlier than initially planned and are raising rates in some cases aggressively. Market expectations and central-bank guidance point to more monetary tightening ahead, with policy rates in the U.S. reaching neutral levels and potentially a bit beyond. With central banks highly focused on taming inflation, we believe they will be very measured in their approach to monetary easing. The key question on our minds is can the Fed engineer the “soft landing”. History suggests no. We would like to give Chair Powell the benefit of the doubt. Other central-bank priorities such as creating conditions for full employment, ensuring financial-market stability, reducing inequality, and limiting climate change unfortunately do not appear to be a focus currently. Pricing in futures markets suggests investors expect the fed funds rate to rise to 2.80% one year from now, which would require at least two more 50-basis-point increases followed by several 25-point increases. We think this is somewhat aggressive given our global growth outlook. In addition, we believe Chair Powell will be willing to let inflation in the U.S. economy run a little hot to avoid recession or stagflation.

Recession angst, bond yields have surged, valuation risk may be alleviated

The rapid and significant re-alignment of interest-rate expectations caused a fixed-income sell-off of historic proportions during the past year. As the U.S. 10-year Treasury yield soared above 3.0% from 1.5%, broad U.S. bond benchmarks lost more than 10% for the largest decline since the early 1980s. The speed and depth of the decline was highly unusual, and we do not expect a similar experience to be repeated going forward. Valuation risk has been significantly reduced and yields are now at much more reasonable levels, according to our models, which suggests that once the near-term distortions related to inflation pass, there is little need for yields to rise much beyond current levels. We have also noted that in past tightening cycles the U.S. 10-year Treasury yield has peaked around the same level as the Fed funds rate. Investors are currently anticipating that the Fed funds rate will peak around 3%, which matches recent levels in the 10-year Treasury. Although yields could continue to rise if extremely high inflation persists, our base case that inflation ultimately moderates means that the bulk of the needed adjustment in yields has already occurred. We think a yield of 2.75% for the 10-year Treasury yield 12 months from now seems reasonable, which could mean no further sustained capital losses for bond holders over the year ahead.

Stock prices decline, driven by uncertain profit outlook, amid slowing growth

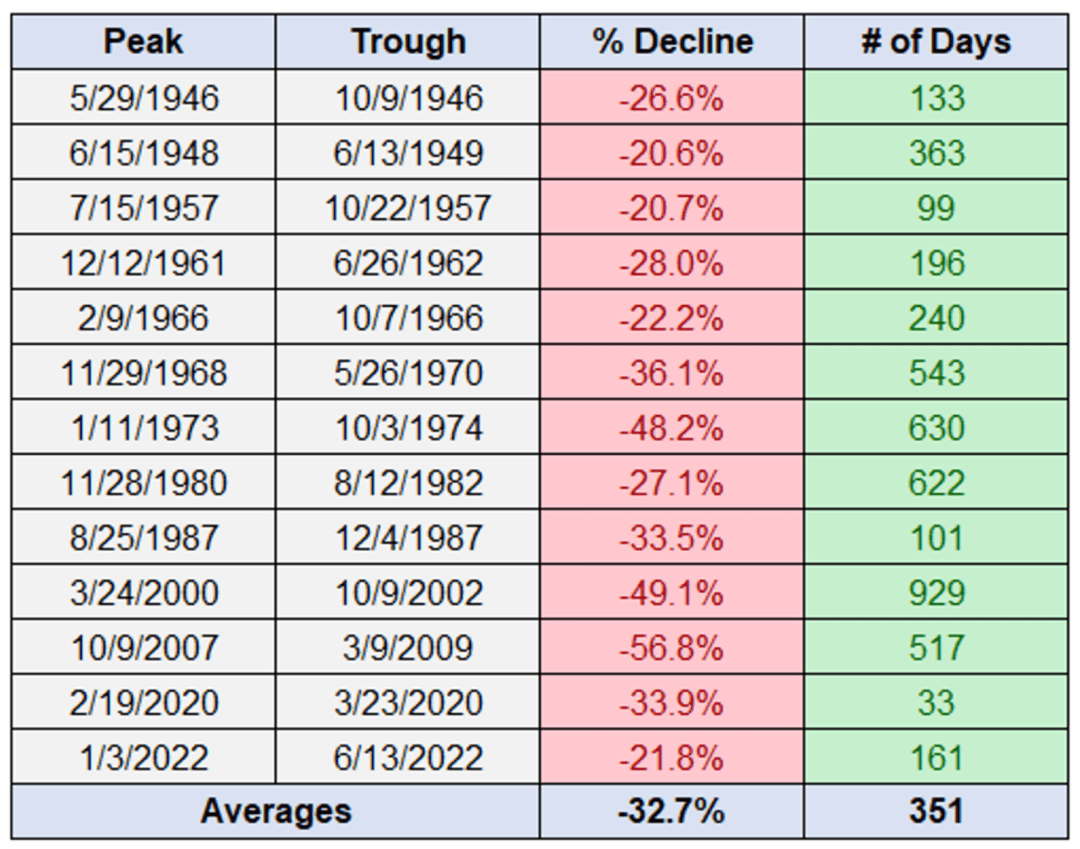

Source: A Wealth of Common Sense, Newday Impact

At the end of the second quarter, we are reminded that this has been the worst first six months of the year for U.S. equities since 1970, over 50 years ago. Only five other occasions have seen declines of greater than 15% over the first six months, however all five turned higher into the back half of the year, with a median gain of +15%+. As we reflect on historical data, the year that might show most similarity for investors to this year is 1962, 60-years ago, appropriately nicknamed “The Kennedy Slide” when the S&P 500 fell 22.5% during the first six months of the year. The crash was attributed to several factors, including inflated stock prices, and failing investor confidence in the market. The good news is the Kennedy Slide of 1962 was relatively short lived, with the market indexes hitting new highs just fourteen months after bottoming out.

In addition, consider the following: During the Great Financial Crisis, amid max pessimism, there were several strong rallies, including ones of 15%, 18%, and 24% — that’s not a typo – before plummeting to a bottom in March 2009. All told, we are currently about six months into this downtrend, which is the 13th decline of 20% or more since WWII.

As we look forward for the remainder of this year, fear of inflation, aggressive monetary tightening by central banks and the increased risk of recession have weighed on stocks. Major indexes have entered bear markets. The Nasdaq Composite Index, heavily concentrated in technology stocks, has fallen as much as 36% from its peak and the S&P 500 Index reached 20% below its peak on an intraday basis. Emerging markets were also down nearly 30% from their prior highs. The outperformer has been Canadian equities, helped by heavy weightings in energy and other resource companies that are benefiting from the high-inflation environment. So far, the decline in stocks has been mostly due to a fall in Price Earnings ratios (P/E’s) that had approached extremes, especially in the highly priced FAANG technology stocks that were most sensitive to interest rate increases. With valuation levels having adjusted meaningfully downward, the focus for the Newday equity team is on Wall Street analysts adjusting consensus earnings expectations downward. Consensus estimates are for low double-digit profit gains over the year ahead. We believe this is too optimistic. Our expectation is for mid-to-high single digit earnings per share growth.

Our base case is we think company profits come through, inflation pressures subside and investor confidence rebounds from the current extreme pessimism. Assuming we are correct in our base case, stocks could be poised to deliver double digit gains over the next twelve months. However, should a downturn or recession come to pass, history suggests that corporate earnings could be vulnerable to declines.

Scotsman’s Outlook Summer 2022

“Ah, I’d love to wear a rainbow every day

And tell the world that everything’s okay

But I’ll try to carry off a little darkness on my back

‘Til things are brighter, I’m the Man In Black”

-Johnny Cash

Source: Fundstrat, Newday Impact

Considering the investment risks and opportunities, and balancing the long-term outlook against near-term risks, we have taken steps to de-risk our portfolios during the quarter. We reduced selectively our exposure to Information Technology and Consumer Discretionary companies. This weighting was re-allocated into Healthcare companies where we have our highest conviction ideas which we think can boost return potential, while recognizing that the risk/reward has diminished in an environment where corporate profits could be vulnerable to a slowdown.

Disclosure

This commentary is provided for information purposes only and is not an offer or solicitation of an offer to buy or sell any product or service. Unless otherwise stated, all information and opinion contained in this publication were produced by Newday Funds, Inc. (“Newday Impact”) and other sources believed by Newday Impact to be accurate and reliable. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions of the financial markets, general investment strategy, or particular investments are not recommendations to clients and are subject to change without notice.

Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Past performance does not guarantee future performance.