Note: The views and opinions expressed in this newsletter are those of the authors and do not necessarily reflect the official policy or position of Newday Impact. Any content provided by our authors is of their opinion and is not intended to malign any religion, ethnic group, club, organization, company, individual, or anyone or anything.

Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Past performance does not guarantee future performance.

IMPACT COMMENTARY

The US Supreme Court’s decision in Dobbs v. Jackson Women’s Health Organization to overturn Roe v. Wade was no surprise. It had been brewing for decades, first taking shape with the presidential campaign of Ronald Reagan, which catalyzed the evangelical vote within the Republican party. It came to fruition with Donald Trump’s final judicial appointment of Amy Coney Barrett, ensuring the necessary votes when the next case came before the Supreme Court. Republican strategists sought to garner greater support and involvement within the party from the evangelical and conservative Christian community during the Reagan presidential campaign by creating focus on the “anti-abortion” movement. The leak of the Dobbs opinion in May 2022 clearly signaled that Roe was dead. Like all deaths, you can plan for it and acknowledge it, but the shock does not set in until it happens, when the gravity and full impact of the situation becomes clear.

We must now ask ourselves: What comes next? How can we reestablish the rights we have lost? What other organizations can we depend on? Given the growing activism of the current court, how will we protect other rights that are now at risk? And importantly for Newday, how can we apply these questions to invest in our values when previous frameworks and fundamentals may no longer apply?

We easily see the immediate impact of the decision that eliminated women’s constitutional reproductive rights. But slightly over the horizon, one sees the larger rights and social constructs that all of us, women, men and families, have lost. Health care decisions may change, as many of the procedures and drugs used in abortion are used in other medical procedures that are vital for women. Dobbs also calls into question other rights, such as same-sex marriage, contraception, and the freedom, even, of how to have sexual relations. And of course, the decision places a disproportionate burden on people of color and lower incomes.

More importantly, and yet harder to see, is our true loss: the loss of faith in the Supreme Court, supposedly the non-partisan pillar of our three co-equal branches of government. Faith in the Presidency and Congress has been eroding for decades, but the Supreme Court seemed unassailable. Lifetime appointments were supposed to set it above politics. On January 6th, 2021, the nation watched as a political rally turned into a riot which became an attempted coup as an armed mob tried to stop the peaceful transfer of power, attacking one of the fundamental tenets of democracy. Our system held, barely. We now confront the Dobbs decision stripping women of their reproductive rights, and Justice Thomas’ clear suggestion that other rights could be stripped too.

What and who do we trust? What new systems must we build to keep pace with these massive changes to our society? In our fight for social justice here at Newday we intend to do just that. The change we must make at our company and our influence at the companies in which we invest must reflect the necessary action that Dobbs dramatically spotlighted last month.

Investing in Our Values After Roe

The economic impact of the Roe decision cannot be underestimated as it has a material impact on our investments.

Based on an amicus brief filed with the Supreme Court in September of 2021 in advance of the Dobbs v. Jackson Women’s Health Organization, a group of 154 distinguished economists and researchers showed the connection between abortion access and economic opportunity. They contend that access to an abortion had a more significant impact on women’s labor force participation than birth control did, leading to increased wages, particularly for Black women. In fact, people of color who are often systemically disadvantaged seek abortions at disproportionate rates. According to a study in the Journal of Pediatrics, approximately 60% of women in the U.S. who have abortions are already mothers, and about one-third of women seeking an abortion say their reason for wanting to terminate the pregnancy is to care for children they already have.

The Institute for Women’s Policy Research estimates that state-level abortion restrictions not only reduce the labor force participation of women and their economic opportunity and potential but could cost as much as $105 billion per year to a state’s economy. On the other hand, they conclude if those same restrictions were eliminated, women already employed would earn $101.8 billion more, and an estimated 505,000 more women from the age of 15 to 44 would be in the labor force and could earn over $3 billion annually, all of which could fuel a state’s economy.

The above indicates the possible effects on our economy if women were forced out of the workforce due to the lack of reproductive options, but what organizations and societal structures can people look to and trust to provide these needs?

One CEO said:

“It’s not my fault, but it is my problem.”

The Edelman 2022 Trust Barometer in May showed:

“More people appear to trust businesses and industries than they do their government and news organizations.”

Greater responsibility now falls on business leaders as workplace issues arise from not only the Dobbs decision but other Supreme Court decisions that may be made in the weeks surrounding and ensuing that will remain a point of focus and contention.

We believe Newday’s focus on corporate governance is critical to our investment selection criteria and at the heart of investing in our values. Looking at our DEI portfolio specifically, we look to invest in companies that prioritize hiring women and minority employees across all levels of an organization. These companies often monitor gender and minority pay gaps and benefits, have disclosed evidence through internal programs and policies that all employees have equal opportunities for advancement, and have even created employee resource groups to encourage and manage discourse around sensitive topics. While the exact details were somewhat scant, six of our top ten holdings in that strategy (i.e., Microsoft, Apple, Amazon, Alphabet, Accenture, and Kroger) came out and either reiterated their healthcare policies regarding the recent Supreme Court’s decision or improved upon them to include travel and/or relocation expenses. While some HR experts say it is very likely that some companies are offering travel benefits but aren’t making public announcements about it due to the possible backlash, we at Newday applaud our portfolio constituent’s willingness to publicly state they are covering the increased expenses of women managing their reproductive options and believe it is a testament to their continued focus on supporting and improving the diversity and equity of its workforce.

The legal landscape is moving quickly. States which ban abortion are looking to impose penalties on their citizens who cross state lines to receive reproductive care and/or on the doctors treating their “citizens”. Companies are trying to determine how best to respond to the Dobbs decision for the benefit of their employees and stakeholders. Newday believes the companies that will thrive and outperform in these trying and unpredictable times will be those that are the most innovative and remain closely involved in corporate action and in the evolution of this new paradigm. At Newday, we believe difficult questions must be asked to ensure the companies in which we invest in do reflect our values.

We welcome the opportunity to have further discussions about how your portfolio can best support women’s reproductive rights.

Please call me at 917-582-5190 or email me at anne@newdayinvesting.com if you’d like to have a conversation.

Q2 2022 GLOBAL EQUITY OUTLOOK COMMENTARY

“Economic headwinds are increasing; inflation remains problematically elevated and financial conditions are tightening. Asset prices have experienced a sharp decline in the face of rapidly rising interest rates, slowing global growth and greater uncertainty in the macro-outlook than we have experienced in years”.

Downgrading growth forecasts as headwinds intensify

Source: Piper Sandler, Newday Impact

Our proprietary model has now started to signal a deceleration in global GDP growth for 2022. This quarter we have further reduced our forecast and now expect growth to be particularly weak in 2023. The key headwinds to the global economy include unacceptably high inflation, aggressive central-bank tightening, a global commodity shock (oil in particular), the continuation of supply-chain challenges and damage from China’s zero-tolerance COVID-19 policy. Because of this combination of headwinds, we gauge that the risk of recession is heightened over the next two years. For the developed world, this outlook translates to our model forecasting 2.5% GDP growth in 2022, less than half the 5.4% rate achieved in 2021, followed by just 1.2% growth in 2023. Except for 2020’s pandemic shock, the 2023 forecast would represent the weakest annual GDP growth performance in more than a decade. Our model is also now signaling a deceleration in the emerging-markets growth outlook and is calculating overall growth of just 3.3% in 2022 and 3.7% in 2023 for developing nations. The acceleration from one year to the next in large part reflects Russia’s economic collapse in 2022. These growth rates remain well below historical levels for emerging markets.

Unacceptably high inflation persists

Source: Piper Sandler, Newday Impact

Inflation sitting at multi-decade highs is the dominant challenge for this economic, business cycle. We expect pricing pressures to remain elevated in the short to medium term before eventually falling back toward longer-term norms. In the short term, high commodity prices, supply-chain challenges, a housing boom, and lingering tailwinds from monetary and fiscal stimulus are likely to keep inflation running hot. We look for inflation to be in a range of 6% to 8% in 2022 across most of the developed world and expect it to remain above normal in 2023, albeit meaningfully lower. Inflation pressures are broadly based but we expect them to calm as monetary and fiscal stimulus are being dialed back, commodity prices are unlikely to continue rising at the pace that they have over the past year as global growth slows. We also anticipate the housing market cools as prices feel the weight of higher interest rates. Over the longer term, we expect inflation to continue falling as structural factors such as demographics limit consumer price pressures. But we also recognize that forces such as climate change, a partial reversal of globalization and a rebalancing of powers between employers and employees may provide offsets. As a result, we expect that inflation may ultimately settle a bit higher than the Federal Reserve’s (Fed) 2% target over the long term, versus slightly below 2% over the decade prior to the pandemic.

U.S. dollar has benefited from risk aversion, weakness likely to materialize

The U.S. dollar (greenback) has steamrolled other currencies thanks to being a beneficiary from risk aversion amid Russia’s invasion of Ukraine, together with expectations that the U.S. Fed will increase interest rates faster than its global peers. Although we have pushed back the timing for when we think U.S.-dollar weakness might return, we still expect the greenback to decline in the medium to longer term given that the dollar is meaningfully above its purchasing power parity with other world currencies and that much of the Fed hawkishness and expected economic weakness abroad are already priced in. Key markers that would strengthen our conviction that the U.S. dollar may have peaked include a slowdown in U.S. economic activity, a hawkish shift in tone from the European Central Bank, signs that Asian policymakers may step in to support their currencies and/or a de-escalation of the war in Ukraine. We continue to expect the U.S. dollar to depreciate against the major developed-world currencies over the year ahead.

Interest rates globally are on the rise, quickly…

With inflation elevated globally and economic conditions tight, central banks have been forced to act urgently. Global central banks have started tightening earlier than initially planned and are raising rates in some cases aggressively. Market expectations and central-bank guidance point to more monetary tightening ahead, with policy rates in the U.S. reaching neutral levels and potentially a bit beyond. With central banks highly focused on taming inflation, we believe they will be very measured in their approach to monetary easing. The key question on our minds is can the Fed engineer the “soft landing”. History suggests no. We would like to give Chair Powell the benefit of the doubt. Other central-bank priorities such as creating conditions for full employment, ensuring financial-market stability, reducing inequality, and limiting climate change unfortunately do not appear to be a focus currently. Pricing in futures markets suggests investors expect the fed funds rate to rise to 2.80% one year from now, which would require at least two more 50-basis-point increases followed by several 25-point increases. We think this is somewhat aggressive given our global growth outlook. In addition, we believe Chair Powell will be willing to let inflation in the U.S. economy run a little hot to avoid recession or stagflation.

Recession angst, bond yields have surged, valuation risk may be alleviated

The rapid and significant re-alignment of interest-rate expectations caused a fixed-income sell-off of historic proportions during the past year. As the U.S. 10-year Treasury yield soared above 3.0% from 1.5%, broad U.S. bond benchmarks lost more than 10% for the largest decline since the early 1980s. The speed and depth of the decline was highly unusual, and we do not expect a similar experience to be repeated going forward. Valuation risk has been significantly reduced and yields are now at much more reasonable levels, according to our models, which suggests that once the near-term distortions related to inflation pass, there is little need for yields to rise much beyond current levels. We have also noted that in past tightening cycles the U.S. 10-year Treasury yield has peaked around the same level as the Fed funds rate. Investors are currently anticipating that the Fed funds rate will peak around 3%, which matches recent levels in the 10-year Treasury. Although yields could continue to rise if extremely high inflation persists, our base case that inflation ultimately moderates means that the bulk of the needed adjustment in yields has already occurred. We think a yield of 2.75% for the 10-year Treasury yield 12 months from now seems reasonable, which could mean no further sustained capital losses for bond holders over the year ahead.

Stock prices decline, driven by uncertain profit outlook, amid slowing growth

Source: A Wealth of Common Sense, Newday Impact

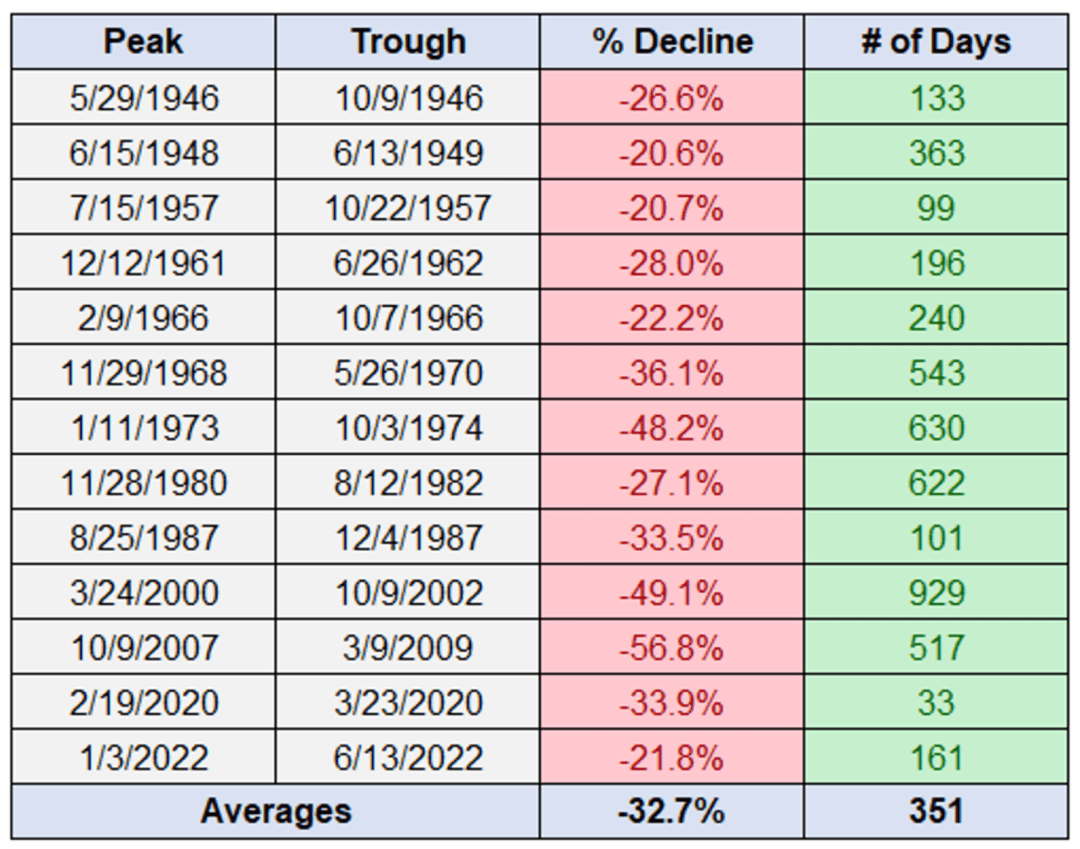

At the end of the second quarter, we are reminded that this has been the worst first six months of the year for U.S. equities since 1970, over 50 years ago. Only five other occasions have seen declines of greater than 15% over the first six months, however all five turned higher into the back half of the year, with a median gain of +15%+. As we reflect on historical data, the year that might show most similarity for investors to this year is 1962, 60-years ago, appropriately nicknamed “The Kennedy Slide” when the S&P 500 fell 22.5% during the first six months of the year. The crash was attributed to several factors, including inflated stock prices, and failing investor confidence in the market. The good news is the Kennedy Slide of 1962 was relatively short lived, with the market indexes hitting new highs just fourteen months after bottoming out.

In addition, consider the following: During the Great Financial Crisis, amid max pessimism, there were several strong rallies, including ones of 15%, 18%, and 24% — that’s not a typo – before plummeting to a bottom in March 2009. All told, we are currently about six months into this downtrend, which is the 13th decline of 20% or more since WWII.

As we look forward for the remainder of this year, fear of inflation, aggressive monetary tightening by central banks and the increased risk of recession have weighed on stocks. Major indexes have entered bear markets. The Nasdaq Composite Index, heavily concentrated in technology stocks, has fallen as much as 36% from its peak and the S&P 500 Index reached 20% below its peak on an intraday basis. Emerging markets were also down nearly 30% from their prior highs. The outperformer has been Canadian equities, helped by heavy weightings in energy and other resource companies that are benefiting from the high-inflation environment. So far, the decline in stocks has been mostly due to a fall in Price Earnings ratios (P/E’s) that had approached extremes, especially in the highly priced FAANG technology stocks that were most sensitive to interest rate increases. With valuation levels having adjusted meaningfully downward, the focus for the Newday equity team is on Wall Street analysts adjusting consensus earnings expectations downward. Consensus estimates are for low double-digit profit gains over the year ahead. We believe this is too optimistic. Our expectation is for mid-to-high single digit earnings per share growth.

Our base case is we think company profits come through, inflation pressures subside and investor confidence rebounds from the current extreme pessimism. Assuming we are correct in our base case, stocks could be poised to deliver double digit gains over the next twelve months. However, should a downturn or recession come to pass, history suggests that corporate earnings could be vulnerable to declines.

Scotsman’s Outlook Summer 2022

“Ah, I’d love to wear a rainbow every day

And tell the world that everything’s okay

But I’ll try to carry off a little darkness on my back

‘Til things are brighter, I’m the Man In Black”

-Johnny Cash

Source: Fundstrat, Newday Impact

Considering the investment risks and opportunities, and balancing the long-term outlook against near-term risks, we have taken steps to de-risk our portfolios during the quarter. We reduced selectively our exposure to Information Technology and Consumer Discretionary companies. This weighting was re-allocated into Healthcare companies where we have our highest conviction ideas which we think can boost return potential, while recognizing that the risk/reward has diminished in an environment where corporate profits could be vulnerable to a slowdown.

COUNTRY GOVERNANCE RESEARCH COMMENTARY

Ukraine continues to hold out against Russian invasion

Russia’s unrelenting assault on Ukraine continued into its fifth month, with Russia using its advantage in artillery and heavy weapons to make progress in taking over more territory in the eastern Donbass region, whose “liberation” Putin has described as the main goal of his so-called special operation. While the Russians have been able to bulldoze forward by levelling cities with long-range fires their advances have come at great expense to them in men and materiel. The tactic of the Ukrainians has been to engage the Russians in urban combat where the Russian advantage in firepower is diminished in order to make any advance as painful as possible for the invaders. After holding out for weeks, the Ukrainians made what they described as a tactical retreat from the city of Severodonetsk, which had been the administrative center of Ukrainian controlled Luhansk province. The grueling fighting required the Russians to concentrate a tremendous amount of their overall combat capability in order to take over a relatively small piece of terrain. The British Ministry of Defense has said the fighting has left the Russian’s armed forces “hollowed out.”

Implications: Flows of heavy weapons from Western partners have continued including the arrival of American multiple-launch rocket systems, though the Ukrainians have implored that the weapons are not yet coming fast enough or in sufficient numbers for them to be able to turn back the Russian invasion. Western partners for their part have said they will continue to support Ukraine “for as long as it takes.” As more weapons arrive over the summer the hope for the Ukrainians is that these deliveries will be enough to put them in a better position to push back against Russia’s increasingly depleted forces.

Macron loses majority in French legislative elections

Recently reelected French President Emmanuel Macron was dealt a setback when his centrist coalition failed to win an absolute majority in Parliament. Mr. Macron’s Ensemble alliance won 245 seats in the 577-seat National Assembly, more than any other political group, but less than the outright majority that he had had since 2017. While the opposition also failed to win a majority that could have forced a “cohabitation” arrangement, support for populist parties on the right and left surged. An alliance of left-wing parties led by far-left politician Jean-Luc Mélenchon won 131 seats, making it the biggest opposition force in the National Assembly. On the other end of the political spectrum, National Rally, Marine, Le Pen’s far-right party, secured 89 seats, a historic record and ten times more than the 8 seats the party won in the last legislative election held in 2017. In contrast to his first term, when he had a reputation for largely ignoring parliament, the new legislative makeup will necessitate compromise and coalition building to pass his agenda.

Implications: Without a majority in parliament Macron’s promised reforms will likely be less ambitious, meaning that plans to overhaul the country’s complex and expensive pension system and raise the retirement age to 65 from 62 will be even more difficult. Macron could eventually call a snap election if legislative gridlock stymies his government.

Israel’s cycle of elections resumes following government’s collapse

Israeli Prime Minister Naftali Bennett announced he was asking for the dissolution of the Knesset, setting Israel up for its 5th election in the past 3 years. Bennett led an unlikely coalition of parties for just over a year before their political contradictions made it impossible to govern. The eight ideologically diverse parties had come together with the shared purpose of ousting former Prime Minister Benjamin Netanyahu, but the alliance of right, left and for the first time an Arab party, shared little else in common. Netanyahu has been the opposition leader for the past year, and he and his allies have placed unrelenting pressure on the government. Two right-wing lawmakers in Bennett’s coalition defected to Netanyahu’s Likud party stripping the government of its legislative majority. Then the final straw came when the government was unable to extend a controversial law granting Israel’s West Bank settlers special legal status. Bennett, a former settler leader, said he would end his coalition government rather than risk the laws expiration. Netanyahu celebrated the government’s collapse and is hoping for a comeback in the next election.

Implications: Netanyahu’s Likud party looks likely again to emerge as the largest party in parliament following elections planned for October. However, the dynamics that have prevented the formation of a stable government and led to a succession of inconclusive elections still remain. Without a breakthrough there could be a continuing cycle of more rickety coalition governments, more leadership collapses, and more elections.

Disclosure

This commentary is provided for information purposes only and is not an offer or solicitation of an offer to buy or sell any product or service. Unless otherwise stated, all information and opinion contained in this publication were produced by Newday Funds, Inc. (“Newday Impact”) and other sources believed by Newday Impact to be accurate and reliable. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions of the financial markets, general investment strategy, or particular investments are not recommendations to clients and are subject to change without notice.

Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Past performance does not guarantee future performance.